August 2024 Commercial Real Estate Market Insights

With inflation and the labor market continuing to ease in July, the Federal Reserve's rate cuts aren't far off. Among all sectors in commercial real estate, the office sector, in particular, is eagerly awaiting these cuts. Office vacancy rates remained at a record high of 13.8% in July, underscoring the sector's ongoing challenges. Meanwhile, both retail and industrial fundaments softened further in July, with net absorption falling by 40% and 68% compared to a year ago in these two sectors, respectively. On the other hand, demand for apartments continued to surge as elevated mortgage rates hurt housing affordability.

Below is a summary of how the major commercial real estate sectors have performed as we entered the second half of the year:

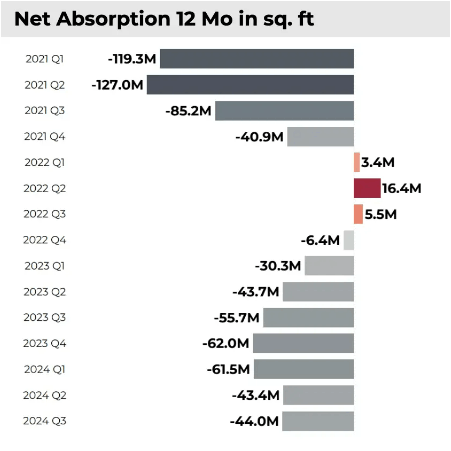

Office Properties

Office vacancy rate remained at record highs, with vacated office spaces still outpacing those being occupied. The outlook suggests that the vacancy rate will likely rise further with negative net absorption, which is expected to persist at least through the remainder of the year and the year after. Leasing activity, an indicator of demand and interest from potential tenants, has declined even more, now sitting 63 percentage points below the pre-pandemic average. But, on a positive note, the pace of additional vacancies has slowed down. The surplus of unoccupied office space has reduced from nearly 58 million square feet a year ago to 44 million square feet in July 2024.

Multifamily Properties

By contrast, the multifamily sector benefited from elevated mortgage rates in July. Net absorption was 90% higher than a year ago, sitting at 470,000 units. Another sign of strong demand in the sector is that landlords are offering fewer discounts on their initial asking rents compared to the pre-pandemic average. However, despite this robust demand for rental units, elevated completions and units under construction have kept the multifamily vacancy rate near 8% and rent growth at around year-over-year.

Retail Properties

Availability conditions in the retail sector remained tight in July. Since the end of last year, only 4.7% of retail space is available for lease, the lowest level on record. This limited availability of retail spaces is the primary reason why the retail vacancy rate has stayed near 4% since the end of 2022, despite the slowdown in demand for retail spaces. Specifically, retail net absorption is down by 40 percentage points compared to a year earlier. With fewer retail spaces under construction, the fundamentals of this sector are expected to remain tight for the rest of the year.

Industrial Properties

The industrial sector continued to lose momentum in July. Net absorption was nearly 70 percentage points lower than a year ago, while rent growth decelerated significantly, dropping to 3.6% from 8.1%. The vacancy rate also rose to over 6.5% from 5.1%. With inventory levels at record highs, the outlook suggests further softening in this sector for the remainder of the year. However, easing inflation in the coming months may boost demand for goods. This usually creates a ripple effect, increasing the need for industrial spaces to manage production, storage, and distribution.

Hotel Properties

As we start Q3 2024, the hospitality sector is maintaining stability. Hotel occupancy rates have leveled off at around 63%, remaining roughly 3% below pre- pandemic figures, which suggests that a complete recovery may be elusive due to the prevalence of remote work. Nevertheless, average daily rates and revenue per available room have now exceeded pre-pandemic benchmarks.

Categories

Recent Posts